Municipal tax rates

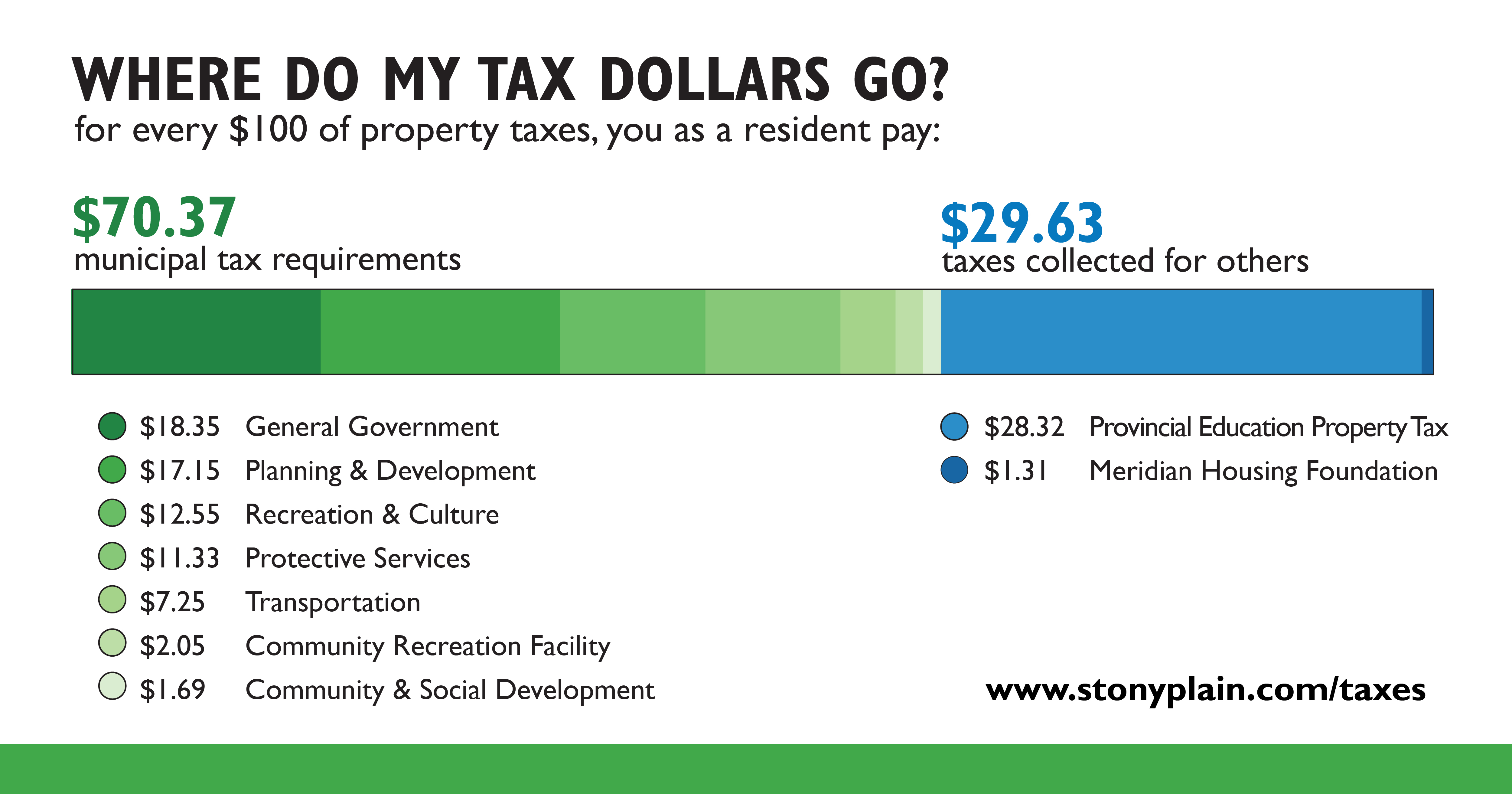

The costs of providing services, such as community amenities, programming, roads, public safety, parks and more, are shared by property owners through the municipal portion of your property taxes.

Annually, through the budgeting process of the Corporate Plan, the Town reviews how much money is needed to pay for municipal programs and services that are necessary to maintain and enhance the high standard of living in the Town of Stony Plain. The Corporate Plan is then presented to Town Council to identify where they feel money is needed most. Council sets the municipal tax rate in the spring of each year to help meet these needs.

Education tax rates

While education taxes for the 'Alberta School Foundation' appears on your tax bill, the tax rates are set by the Government of Alberta. The education tax is collected by the Town of Stony Plain and remitted directly to the Government of Alberta for distribution throughout the province.

For further information regarding Education Property Taxes, please visit:

Education property tax | Alberta.ca or call 780-422-7125.

Meridian Housing Foundation tax rates

In accordance with the Alberta Housing Act, these tax rates are set by the Meridian Housing Foundation for the Town of Stony Plain, the City of Spruce Grove, and Parkland County. Taxes are collected by these municipalities and remitted directly to the Meridian Housing Foundation to help provide housing for seniors 65 and older. This is not additional revenue for the Town.

For further information regarding the Meridian Housing Foundation, please visit:

Meridian Housing Foundation or call 780-963-2149.

View the Tax Rate Bylaw for current rates.